Data Products

How Kitties Helped BBVA to Detect Credit Card Fraud

13/03/2018

A group of data scientist at BBVA Data & Analytics has developed a Deep Learning model that uses a novel approach to credit card fraud detection.

The methodology has been applied by BBVA’s data scientists Juan Arévalo and Jordi Nin, together with Universitat Politécnica de Valencia professors Roberto Paredes and Jon Ander Gómez. It is inspired by Andrew Ng work (Baidu’s Artificial Intelligence luminary) on neural networks build to make image recognition more efficient.

Nin explains that they explored a more efficient approach to model training and test classification for a massive amount of transactions of which just a handful (this is only comparatively because credit card fraud amounted to 1.3 billion euros in 2012, despite representing only 0.04% of the total) are considered fraudulent.

In the dataset used in this pattern recognition experiment, only 1 out of 5000 transactions are fraudulent. The biggest challenges for this kind of unbalanced datasets are the difficulty of performing a efficient training of a neural network; and, secondly, the need for a speedy recognition of a suspicious transaction.

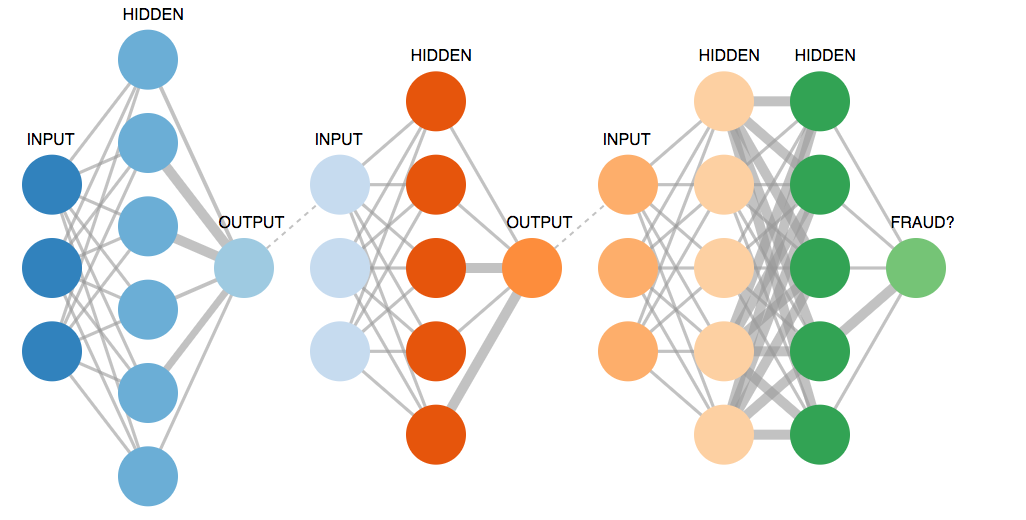

The solution was to apply filtering in cascades so we can isolate what transactions are genuine and obtain a reduced sample with a maximum of fraudulent credit card purchases to train our deep neural network. “We found that two levels of filtering were sufficient to reduce the ratio of genuine to fraudulent transactions to acceptable levels”, points out Nin.