How Innovation Will Become More Customer-Focused. Our Participation at ENTER 2018

ENTER 2018, organized annually by the International Federation for Information Technology and Travel and Tourism (IFITT), took place the last week of January in Jönköping (a lovely Swedish city on the south shore of lake Vättern). This year’s theme was “Digital tourism: engagement, content, and networks”. There was a good combination of industry and academia speakers lined up, covering topics ranging from use of robots in the hospitality industry to last minute price optimization (program available here).

However, two key concepts were present throughout the conference: personalization and customer empowerment. In both cases, knowing the customer through data is what allows the industry agents to improves their relationship 一 we have been pursuing these strategies at BBVA as a way to better engage with our clients. IBM Watson’s Thierry Gnych summed up these idea and the current trend of “changing from being known by the customer to knowing the customer”.

Keynotes we liked

One of the things I liked the most about the keynotes was the diverse backgrounds of the speakers. From an engineer to an anthropologist, all of them presenting the challenges the travel industry is and will be facing. This diverse expertise led to multiple approaches and enriched the discussion. I personally liked the following keynotes:

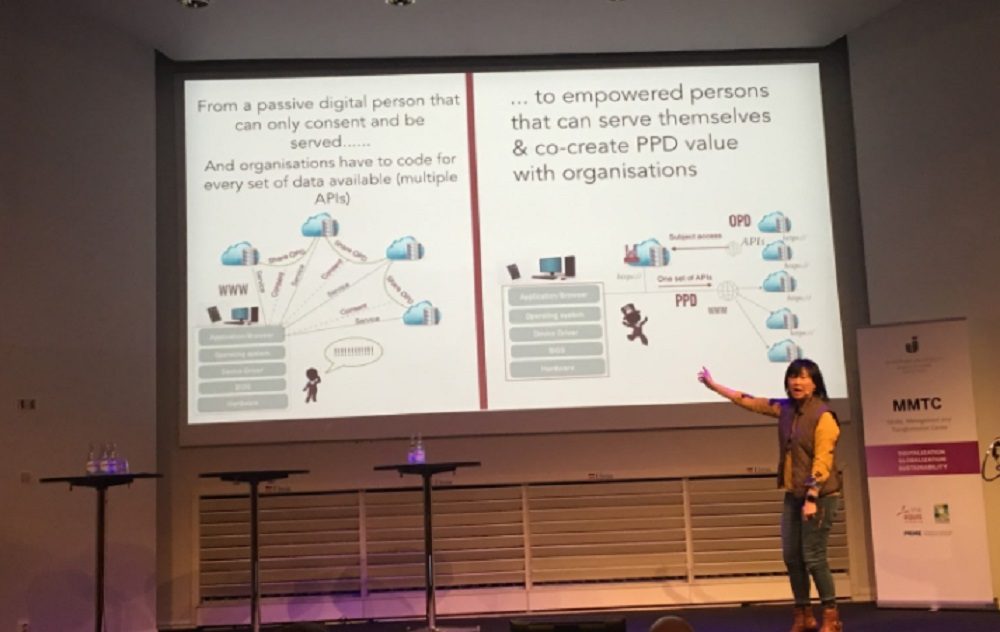

Irene Ng presented the HAT (Hub-of-All-Things), a technology that gives the users the control of their personal data. In the context of GDPR and PSD2, this platform gives the users the chance to collect their personal information from their apps and decide if they want other companies to use it and how. Thus, users can get value from their data. It is quite interesting to see how customers are going to react to the new conditions and whether they will use this kind of platforms to manage their data, and even monetize it. The speaker pointed out that this is a great opportunity for the travel industry to use new data sources to improve their knowledge of the customers.

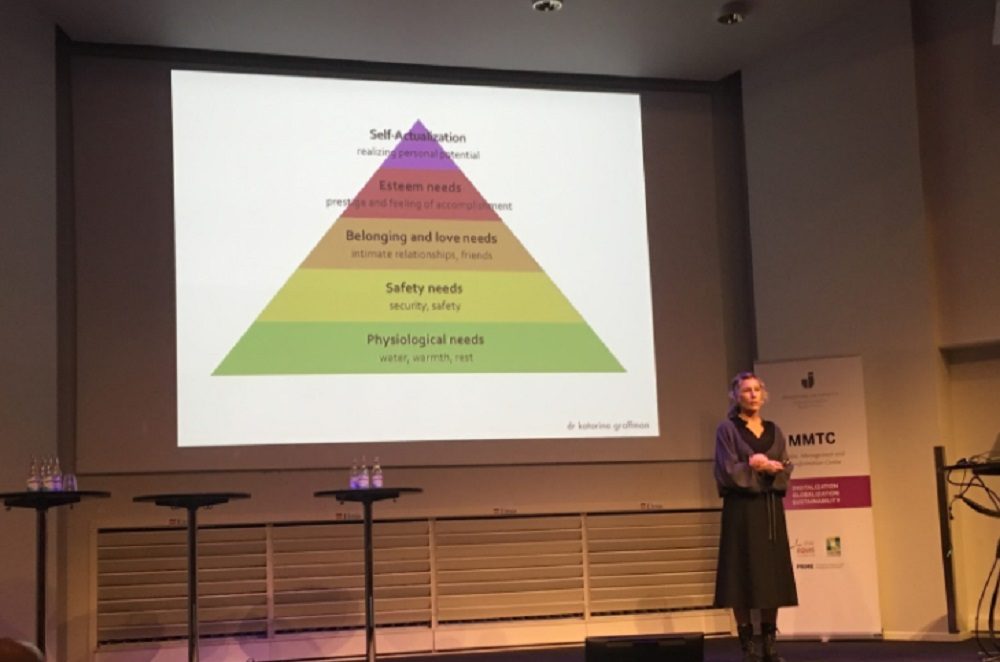

Katarina Graffman, anthropologist from the Uppsala University, talked about the way new generations (Millennials, Gen Z,…) behave and interact with technology. Her point was that, if companies want to get to know these customers and engage them, they need to rethink the data they are collecting. Concepts such as immediacy, security, trust or personalization do not mean the same for people born in different decades and those who adapt better to each customer will have competitive advantage.

Rotem Shenor, from the University of Agder, showed a detailed picture of the state of crowdfunding in the European countries and how the regulation has impacted it. I really liked to find that most of the travel industry is seeing crowdfunding as an opportunity to innovate instead of as a threat.

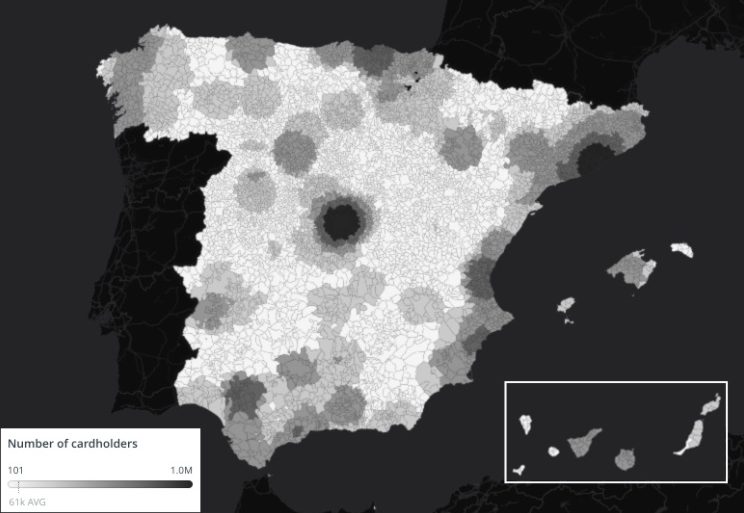

We’ve got a slot! This is what we showed

Behind the title “Using transactional data to determine the usual environment of cardholders” we presented our methodology to infer the area where cardholders carry their daily lives out using card transactions. This information allows us to distinguish between touristic (those made outside the usual environment area) and non-touristic transactions. We could have used the cardholders declared address, but the new methodology is more accurate since it detects the routines of each cardholder. Some of the aspects we worked on was the adaptability to different kinds of cardholders (from those who use their card every day to those who only use it punctually) and also to different geographies. In fact, this methodology has already been applied to the entire set of BBVA cardholders in both Spain and Mexico with minor adjustments.

Some of the public projects that used the usual environment attribute are the Pueblos Mágicos analysis (the attribute was used to divide between residents and tourists the expenditure made by mexicans) or Urban Discovery (we saw which communities within the cities are more attractive to domestic tourists).

The methodology was given a favourable reception and lots of question were raised about the way to adapt it to different datasets, how to scale it and the access to BBVA aggregated data through the API Market (mainly coming from university researchers).

ENTER 2019 will take place in Nicosia, Cyprus. See you there!