Data Products

Improving Customer Experience with Forecasting Models

19/09/2017

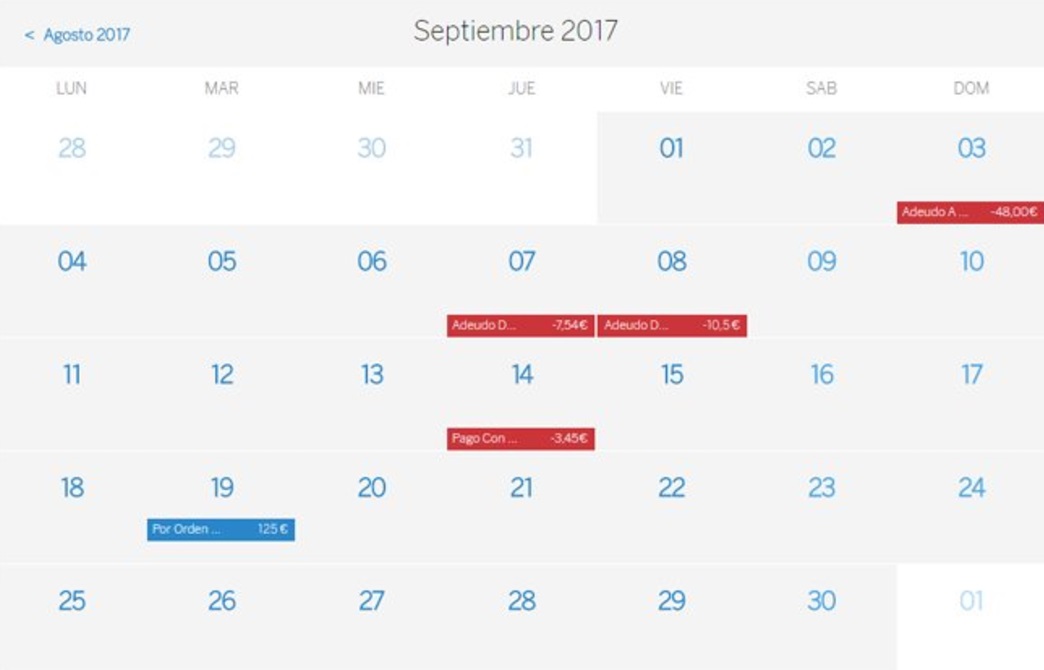

BBVA has recently launched a Finance Calendar feature as part of its web and mobile apps, called “Expense and Income Forecast”

Direct debit and credit cards have made the lives of many easier. They have allowed us to save time and headaches, and helped us finance goods that exceed our monthly purchasing power. Sometimes, they have also created situations when an unforeseen payments came through in an unexpected moment with a low balance the missing payment involves a penalty.

To solve this issue BBVA has recently launched a Finance Calendar feature as part of its web and mobile apps. Called “Expense and Income Forecast”, it helps customers gain control over their account by providing estimations of future recurring income and expenses. This feature is now available as part BBVA’s Personal Finance Manager (PFM) called “My Day to Day”, which is currently used by 1 million clients each month.

The core algorithm, its forecasting engine, was developed by BBVA Data & Analytics using Big Data tools like Apache Spark and implementing a combination of Machine Learning algorithms for time series forecasting. It is another example of how BBVA Data & Analytics applies Data science to improve the financial life of BBVA clients by providing useful information to take decisions.

Customers can see two types of forecasts. On the one hand, the total amount of expenses and incomes expected in a set of financial categories (like groceries, education, or leisure) for the current month. On the other hand, for operations which present a strong temporal recurrent pattern, these are associated with a tentative data and displayed in a calendar. Therefore, customers get a picture of when in the future they will receive a payment or a direct debit from the electricity company or a mortgage, and can prepare for other extraordinary payments that may impact their account balance.