Pricing Strategy Optimization Considering Customer Sensitivity

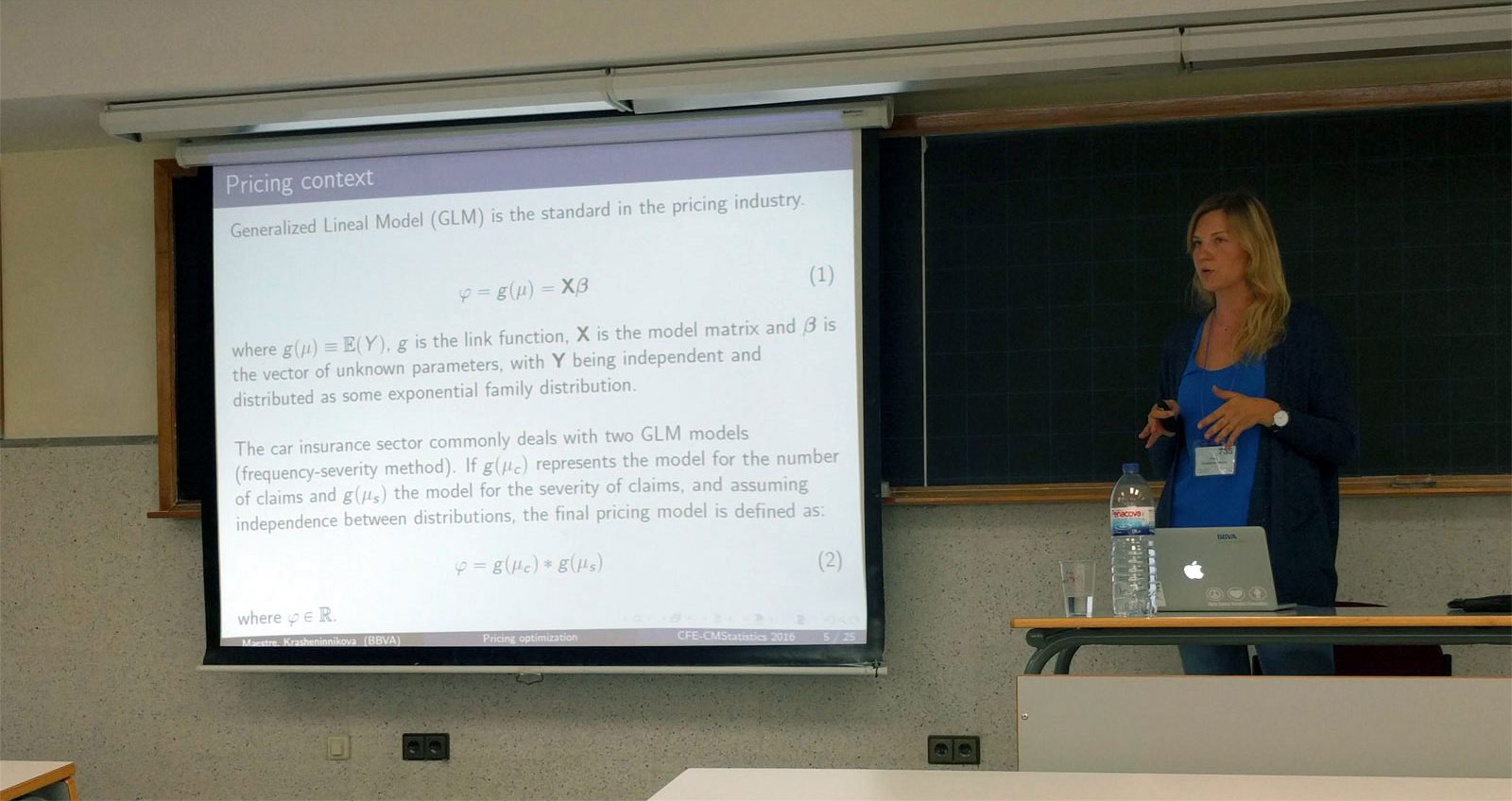

Setting a price for a given customer and product (i.e pricing) is a fundamental problem in the banking sector and is closely related to many financial products, such as insurance or credit scoring. While pricing problems can be solved with standard regression models like Generalized Lineal Models (GLM), a pricing strategy optimization deals with two main components: the pricing model and the customer’s degree of acceptance of a given price. The objectives of the strategy are to:

- Increase retention (probability of acceptance of a given price)

- Increase revenue.

In the recent CFE-CMStatistics 2016 conference, we presented a simple framework to calculate the Pareto frontier of several pricing strategies through Random Optimization (RO) driven by a probabilistic model, maximum decay points (MDP) and business constraints. This methodology yields expected retentions and revenues and allows for the testing of new prices. Practically, our contribution:

- Proposes new prices that dynamically adapt to market necessities.

- Uses models that include business constraints and help limit the search space to optimize and proposes fair prices.

- Uses parallel processing to simulate multiple different scenarios and to select the best.

We provide a detailed description of our methodology in Pricing strategy optimization considering customer sensitivity with Monte Carlo simulations, a publication still currently under review. Additionally, the slides of my presentation on pricing optimization is available below:

As byproduct of that research work we also developed the Holden R library that we hope to make public soon. It was named after pricing theorist Reed Holden.